THE STOCK MARKET MOVES FAST—HERE’S WHAT HAPPENED YESTERDAY

If you blink too long, you might miss a major market move! That’s why staying informed is key, whether you’re an active investor or just watching from the sidelines. Yesterday, we saw big shifts across the U.S. stock market—some that could shape global investing, including for Nigerians looking to build wealth through stocks.

Let’s break it down in simple terms, with a Nigerian perspective.

⸻

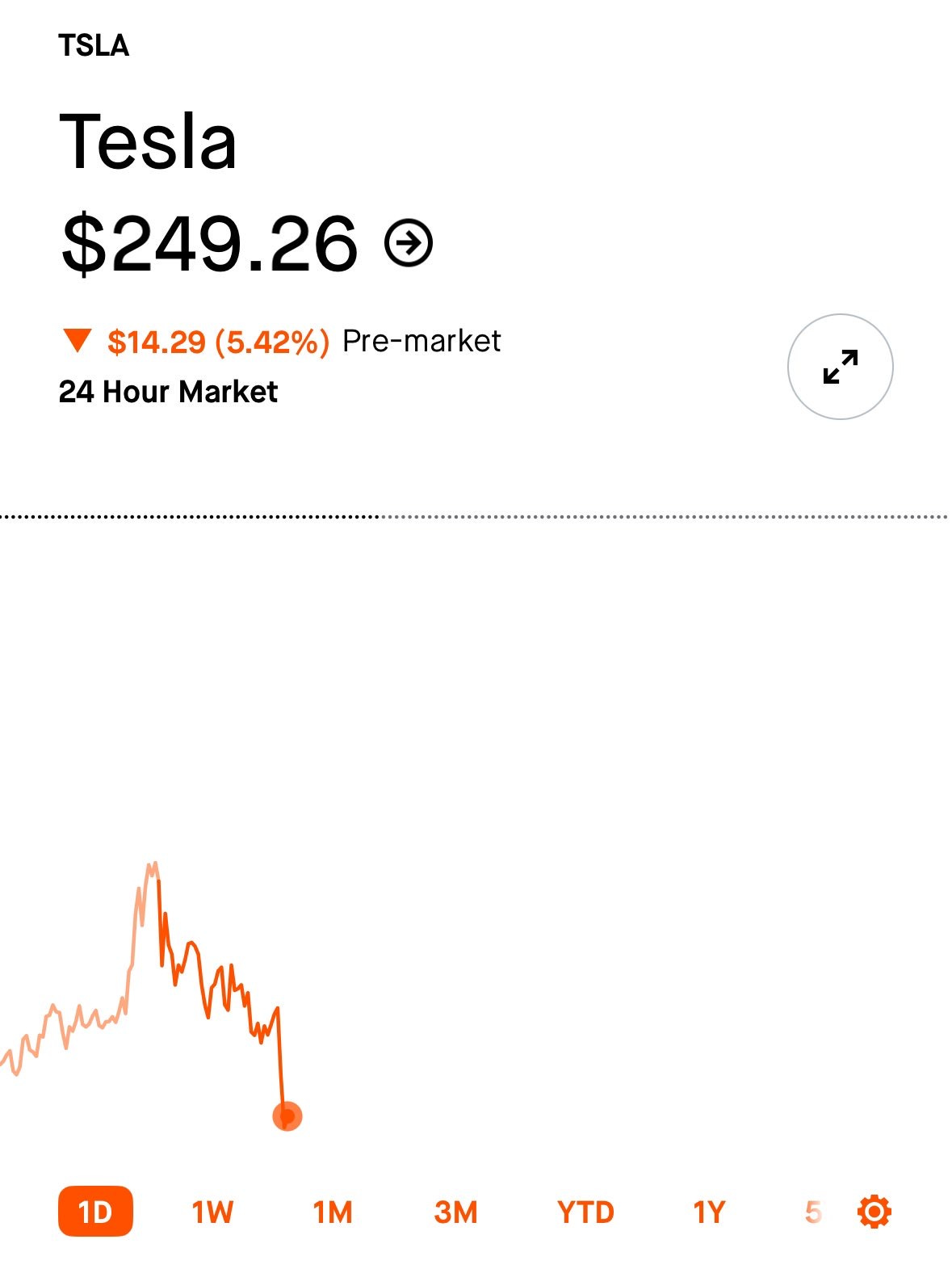

1. Tesla’s Stock Target Drops—Should You Worry?

Tesla ($TSLA) got a price target cut from $474 to $455 by investment bank Stifel. The reason? Lower near-term sales expectations, partly because of politics. U.S. Democrats are turning away from Tesla due to their issues with Elon Musk, which could slow demand.

What does this mean for Nigerian investors?

If you own Tesla shares, don’t panic. This is a short-term adjustment, and the company still has strong long-term potential. If you’re considering investing in Tesla, now might be a good time to research it more carefully.

🔎 Lesson: A stock price drop doesn’t always mean a bad investment. Sometimes, it’s just a short-term reaction to temporary factors. Always look at the bigger picture!

⸻

2. OpenAI Hits a Record-Breaking $300B Valuation

Artificial Intelligence (AI) is not slowing down. OpenAI, the company behind ChatGPT, secured a massive $40 billion funding round, making it one of the most valuable companies in tech. SoftBank alone invested $30 billion!

How does this affect Nigerians?

AI will continue to transform industries worldwide, from banking to healthcare. If you’re investing, consider looking into AI-related stocks like Microsoft ($MSFT), Alphabet ($GOOGL), or even Nvidia ($NVDA), which powers AI computing.

🔎 Lesson: The future is AI. If you’re building an investment portfolio, having at least one AI-related stock might be a smart long-term play.

⸻

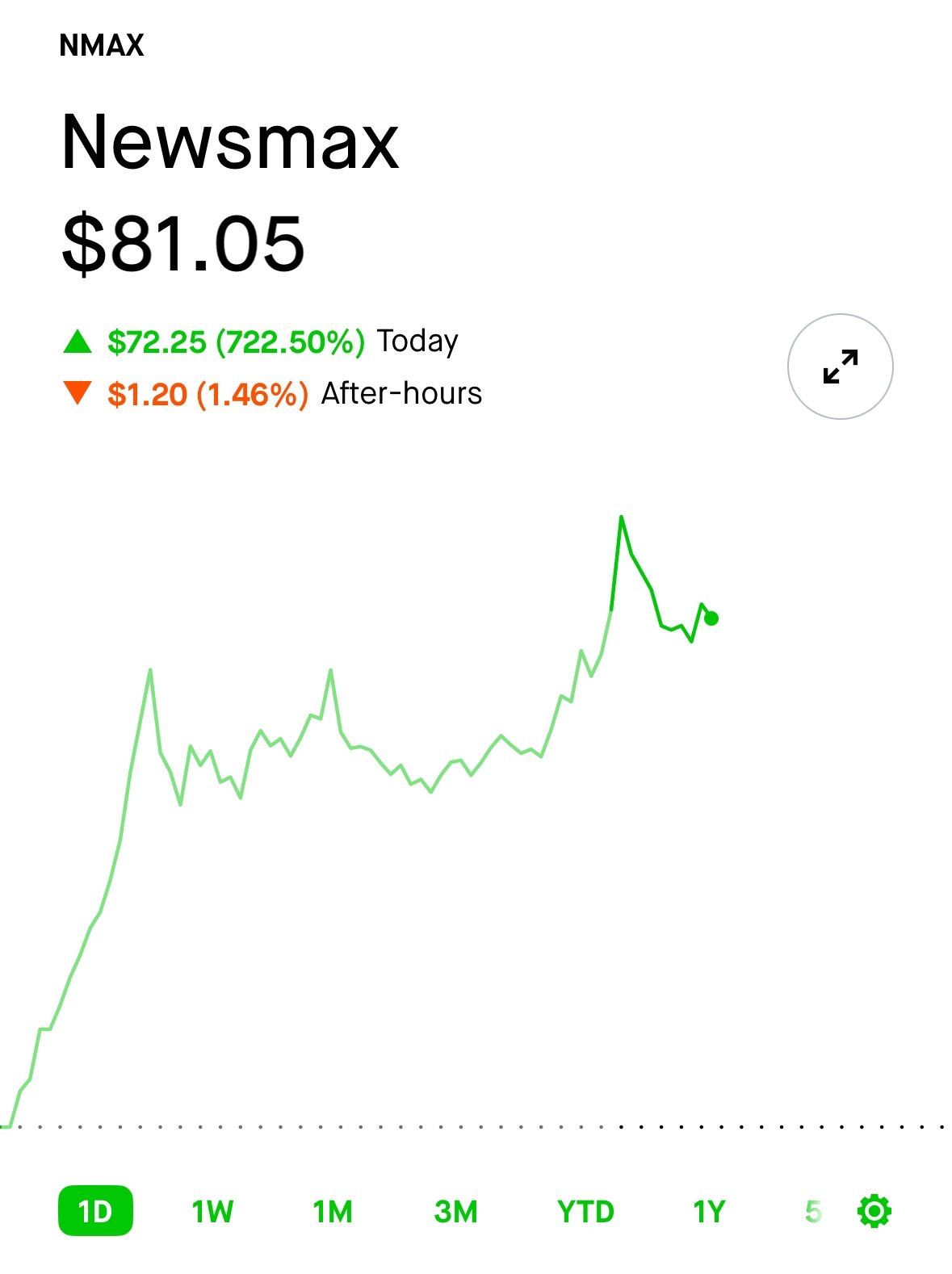

3. Newsmax Stock Explodes—Up 735% in One Day!

Newsmax ($NMAX), a conservative U.S. media company, launched on the New York Stock Exchange at $10 per share. By the end of the day, it had shot up to $83.51—a 735% increase!

This kind of stock movement is not normal. It was driven mostly by hype and retail investors jumping in. If you’re thinking, “Can a Nigerian stock do this?”—yes, but it’s rare. The last time we saw such a speculative move in Nigeria was with stocks like OANDO Ltd., which had a massive surge after listing.

🔎 Lesson: Quick gains like this can be tempting, but they are risky. If you invest in speculative stocks, do so carefully and don’t put all your money in one place.

⸻

4. Goldman Sachs Lowers Its Stock Market Forecast

Goldman Sachs now expects the S&P 500 (a major U.S. stock index) to drop 5% over the next three months and only grow by 6% in a year. They also cut their 2025 earnings forecast due to fears of inflation, tariffs, and slow growth.

For Nigerians investing in U.S. stocks, this means:

• Be selective with your investments.

• Look for solid dividend-paying stocks that can withstand market downturns.

• Don’t rush to buy just because a stock is popular—do your research first.

🔎 Lesson: The best investors make money by being patient. Market dips happen, but strong companies bounce back.

⸻

5. Trump’s Tariffs Could Affect Global Markets

President Trump has imposed a 25% tariff on foreign cars and parts, which will impact companies like Tesla ($TSLA), General Motors ($GM), and Ford ($F). He also threatened a 25%-50% tariff on Russian oil if there’s no Ukraine ceasefire.

For Nigerians, this could affect:

• Oil prices: If oil prices rise, expect increased fuel costs in Nigeria.

• The Naira: Higher oil prices could strengthen the Naira, but trade tensions might weaken global markets.

🔎 Lesson: Politics and economics are connected. When major countries make big decisions, they can affect everything—including our local economy.

⸻

What Should You Do Next?

With all these market changes, it’s easy to feel overwhelmed. But here’s a simple 3-step action plan to keep you on track:

✅ 1. Review Your Portfolio

• Are your stocks still strong, or are you just holding them because everyone else is?

• Do you have a balance of long-term growth stocks and solid dividend-paying stocks?

✅ 2. Plan Your Next Investment

• If you’re just starting, consider investing N50K per month into solid Nigerian and U.S. stocks.

• Look into AI-related stocks or sectors that thrive even in slow markets.

✅ 3. Join a Stock Community

• If you want expert guidance in picking stocks, join our paid stock groupchat where we break down stocks in easy-to-understand ways.

• Need a hands-off approach? We also offer portfolio setup and management services to help you build a solid investment strategy.

Remember, you don’t have to navigate this alone. Investing is a journey, and we’re here to help you make informed, confident decisions.

WALL STREET NEVER SLEEPS—NEITHER SHOULD YOUR MONEY.

Feji Iyeke

Your Money Guy.