What Huawei, Bitcoin & Tariffs Have in Common (Hint: It’s Not Jollof Rice)

A TON OF THINGS HAPPENED IN THE STOCK MARKET YESTERDAY

And if you blinked, you probably missed a few billion dollars

Let me paint you a picture.

You’re sitting in Lagos traffic, sipping your bottle of La Casera, when your friend says, “Guy, have you seen the new Huawei chip?” You roll your eyes. “Which chip again? Plantain chips or computer chip?”

Well, the chip is real. And it’s not for chewing.

Yesterday, Huawei dropped the mic with their new AI chip—the 910C. In plain Naija English, they basically built their own “Nvidia-level” processor. Why? Because America said, “No more Nvidia for you!” and Huawei said, “Bet.” The U.S. is blocking exports of Nvidia’s advanced chips like H20, so China’s tech companies are saying “we go run am” by themselves.

As expected, $NVDA (Nvidia) took a 4.5% punch to the face.

⸻

Meanwhile, Elon Musk dey cook again.

His AI company, xAI, just confirmed they’re building Colossus 2—a massive AI training cluster with 1 million Nvidia GPUs. Not 1,000. Not 10,000. One million. Estimated cost? $25 to $30 billion.

At this rate, if AI was plantain, Elon wants to buy the whole farm.

⸻

Speaking of Elon…

Tesla ($TSLA) reports Q1 earnings today. Wall Street expects $0.46 per share and $22.46 billion in revenue. Not bad, but it’s the same song as last year. Investors are like, “Elon, where’s the growth?”

If Tesla doesn’t pull a rabbit out of its robot hat—maybe from the energy or robotics side—the stock might continue its Shoki dance… downward.

Already down 5.75% yesterday.

⸻

And then, enter our Bitcoin uncle: MicroStrategy ($MSTR)

They just bought 6,556 more Bitcoin, spending about $555.8 million. At this point, I won’t be surprised if MicroStrategy starts minting their own coins.

They now hold 538,200 BTC, at an average cost of about $67,766. Bitcoin is up 12.1% this year. That’s more than some people’s salary increment + bonus + prayers combined.

⸻

What else happened?

• Amazon ($AMZN) got a price downgrade from Raymond James. Their new target is $195, down from $275. Reason? Too much money going into AI, logistics, and supply chains—profits might suffer.

• Netflix ($NFLX) got an upgrade. Price target now at $1,200 after a strong Q1. AI is helping them shoot better content cheaper. Nollywood, are you watching?

• India slapped a 12% steel tariff on imports. “China, abeg slow down with your cheap metal,” they said.

• Air India is buying more Boeing 737 Max jets built for China but undelivered due to—you guessed it—trade drama.

• Japan is resisting U.S. pressure to open its auto and food market. Omo, nobody wants to play ball this week.

• FED’s Goolsbee said inflation looks okay long term, but they’re watching tariffs and global tension.

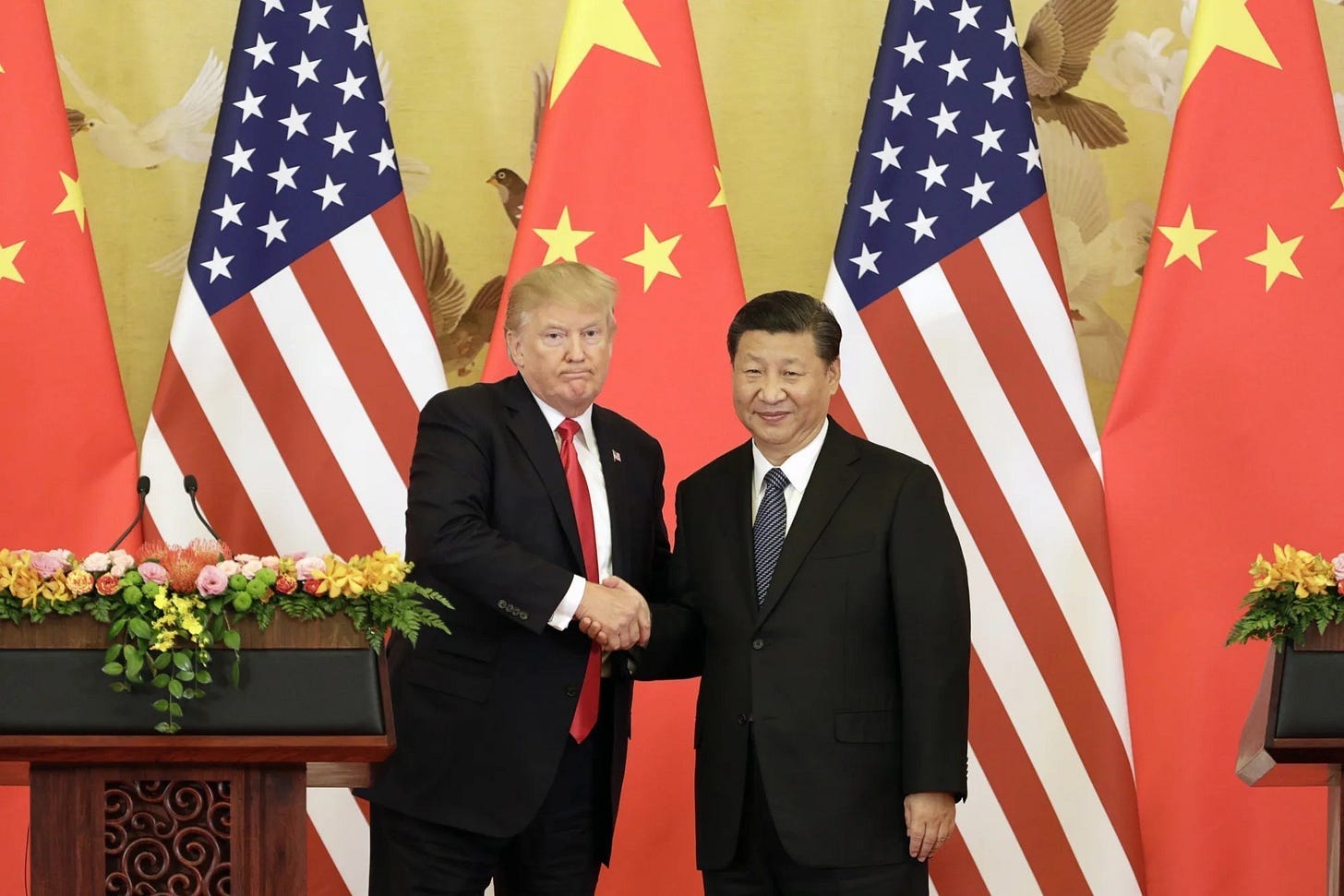

• China came out guns blazing: “If you support America’s tariff war, we go retaliate.” Tension dey everywhere.

⸻

So, what does all this mean for you—the Nigerian investor?

Three things:

1. Geopolitics and tech are dancing Alanta in the market.

As China and the U.S. keep clashing, opportunities are opening up in local champions—like Huawei—and threats are rising for U.S. chipmakers like Nvidia. If you invest in global stocks, diversify your exposure. Don’t put all your dollars in AI alone—spread them like stew on white rice.

2. Bitcoin is getting serious again.

When big companies are throwing half a billion dollars into crypto, you should at least understand the trend—even if you don’t invest. That’s why we teach crypto fundamentals in our monthly mentorship sessions.

3. Earnings season is not for the faint-hearted.

Tesla, Amazon, Netflix, and more are dropping numbers. If you own these stocks (or want to), learn how to read the story behind the numbers. Don’t panic-sell like you’re dodging last bus at Oshodi.

⸻

Want to build a solid portfolio in this madness?

We can help.

At Astra Fidelis, our portfolio setup & management service helps you pick the right Nigerian & US stocks for your goals. No hype. No guesswork. Just smart investing.

Plus, our monthly stock mentorship is where we break down these global stories into local opportunities in plain Naija English. You get access to live sessions, recordings, model portfolios, and more.

Need a guide?

Get our books:

• Nigerian Stocks 101: The Ultimate Guide to the NGX

• The Investor’s Handbook: Stocks Made Easy

They’re packed with real-life lessons and strategies, whether you’re just starting or looking to scale.

[JOIN NOW]

Wall Street may never sleep, but neither do opportunities.

Don’t just scroll, INVEST WISELY.

— Your Money Guy

Astra Fidelis Ltd.